Entrepreneurship for US veterans was a natural option post world war II and the Korean War. But the number of veteran-run businesses have dropped drastically in the past decade. This sudden fall in the numbers of the veteran-owned small businesses also impacts the number of veterans who are hired for employment.

There is still a stigma around hiring war veterans for employment, especially with ones that are physically disabled. It is proven over the years that only an entrepreneur who was a veteran himself trusts and accepts other veterans in his business.

Many veterans have entrepreneurial plans that are amazing. But, they go to the traditional financing institutions like banks where they are asked for two years of entrepreneurial experience for sanction of loan. Most of these veterans are fresh out of the military and face shortfall in this criterion.

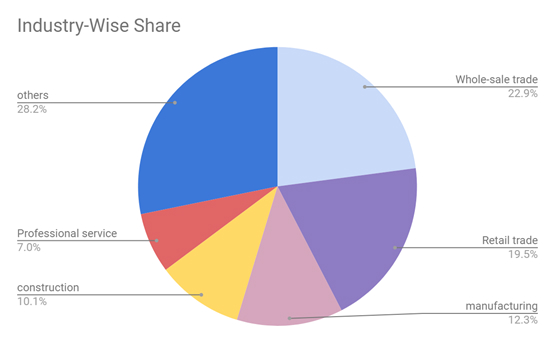

Another major challenge faced by veterans is that they do not explore a lot of small business avenues. A study shows that 71% of the veteran-owned businesses are from these 5 industries; Finance and Insurance, Wholesale trade, retail trade, construction, and professional/ technical services.

There are many more industries like health-care, restaurant business, automobile, etc. that veterans can venture into. This will expand the chances of them succeeding as an entrepreneur.

Successful entrepreneurs are created out of excellent connections they maintain. In today’s all-volunteer armed forces, many veterans come from military families. This isolates them from the non-military Americans. Thus, it is difficult for veterans to mingle with their clients or their vendors. The curbing of outside connections also decreases the number of opportunities that knock on their door.

Though it is difficult for veterans to develop a friendship with non-military citizens, they can seize their opportunity during their service days.

The best advice I can give my fellow “vetranpreneurs” to grow their small business is to NETWORK!

Most of the commissioned officers in the armed forces are from prestigious or ivy league colleges. They are well-connected within their universities and are also investors’ darlings. So befriending them can be helpful when you come out of service and are looking for opportunities.

As a veteran business owner, you might have to face a lot of challenges to start off on your own but if there is a doubt of ‘Do I have it in me to become an entrepreneur?’ then this answer is for you.

You go through so much in the military, but really what the military is teaching you is how to be resilient. You plan a mission, and then you execute, but nothing ever goes according to plan. Your job is to continue to lead in not-ideal circumstances.

The Help You Need to Grow

If you are confident about succeeding in your business but need a little external help to get your start-up running, then these business resources might help,

The US Small Business Administration’s website has a dedicated page (VBOC) of resources for veteran-owned small businesses.

- Warm up: The Pre Business Plan Workshop gives a top-level understanding of running a business and also gives deep learning of using the internet and the digital space to run the business.

- Picking the right concept: The Veteran Based Outreach Center conducts assessments and advises on the right concept suitable for business and also the investment involved. The strengths and weaknesses of the business plans are also discussed.

- Finding the Right Mentor: VBOC will help you maintain the profitability of your business by conducting regular onsite visits, reviewing your financial records, etc.

VBOC’s are in most of the states in the US. So find the one closest to your place or the location where you want to start your business.

Money is another huge stop gate for veteran-run businesses. There are many alternative financing options that benefit veteran-run businesses that can be explored.

The SBA provides upfront guarantee free loans of up to $125,000 for veteran-run businesses. The guarantee is way less than for usual loans even for amounts above $125,000. The SBA also has partnered with other financing firms to get competitive loan quotes which allow you to make informed decisions.

Similarly, if your small business needs immediate funding for replacement, expansion or marketing then you should opt for small business financing options.

Sustaining your business needs a continuous flow of projects. Veteran owned business certification from SBA can help you with this. All the veteran-owned small businesses that have enrolled in this will be given special privileges during government contracts and they will also be alerted if a service related to their field is required in the government offices.

There are many more advantages for service-disabled veterans and women veterans who start their own business. It is said that many more women veterans become entrepreneurs because of these schemes, though the exact number of women veteran-owned small businesses might be slightly tainted by the transfer of businesses from husbands to wives just to access these schemes.

Veterans own approximately 2.52 million businesses in the US and many of these businesses have sustained for years. Dreaming of being an entrepreneur and starting a business is a challenge, be it a veteran or a non-military citizen. Analyzing the weak spots, exploring new avenues, investing in the right technology are some of the things you can do to make your business a successful one. The military is one of the best places where you can learn to lead a team, motivate them to do their best at high-stress situations. Hence, grow and sustain your business by leading your team with confidence and patience through all the challenges and sudden pitfalls.