Knowing what challenges other small business owners are experiencing can help you in determining your strategy. A CB Insights study lists the top obstacles that stand in the way of successful expansion and “No Market Need” comes in top, while “Ran Out of Cash” is a close second. We have also given a few suggestions on how to overcome each challenge but you can find more in the full Guide to Expansion, available here.

Challenge #1: Getting the Product-Market Fit Wrong

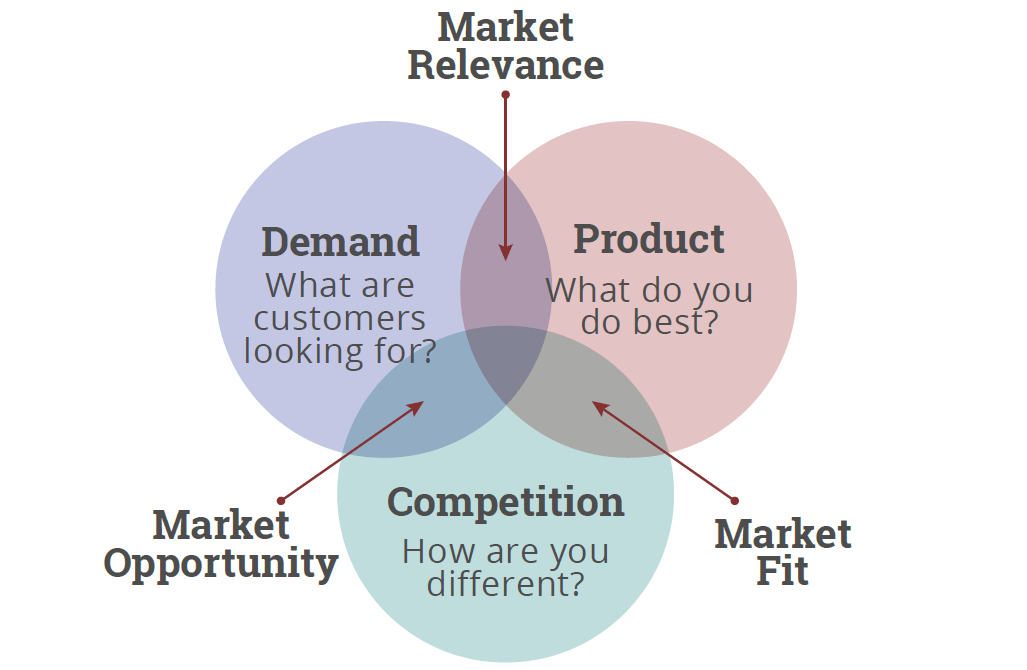

When expanding the range of offered products and services, companies often make the mistake of innovating for the sake of innovation, or because they are excited about new technology—forgetting their target audience.

42% of the companies in the CB Insights study went out of business because

the product they developed wasn’t a good fit for their intended target groups.

When a business looks to expand its offerings, it needs to understand that

a great product…

• … is what customers are looking for

• … is something the business is capable of doing well

• … differentiates it from competitors

Challenge #2: Running into Cash Flow Problems

Called the ‘real life blood’ of a business, cash flow—the actual amount of money coming into and leaving the business—can cripple a business when handled poorly. It is possible to report profits on paper, and yet end up with a cash shortage. This may prevent a business from being able to pay employees on time, or even creditors.

In extreme cases, this can shut the business down altogether. When planning a growth effort, ensure that cash flow is positive by:

• Actively monitoring it, using either a tool or a designated

staff member

• Running through credit checks on potential customers (especially important in businesses involving large contracts with individual

customers, like a construction business)

• Organizing collection strategies, and getting invoicing

right to ensure on-time payment

• Limiting expenses

• Setting up a line of credit through a viable source (more on this

later in the guide)

We created a separate guide to help businesses understand cash flow. You

can download it here.

Challenge #3: Making Hiring or Company Culture Mistakes

When a business expands, it needs to hire quality managers and train new employees, all while making sure existing locations maintain the same standards. For instance, a company may need to hire someone who

can oversee the entire operation. For instance, Zirtual, a business that made a series of financial mistakes, had to lay off 400 employees overnight.

After the event, co-founder and CEO Maren Kate Donovan admitted a key

mistake: not hiring a CFO onto the board. If a healthcare facility known for its excellent service opens in a new location, they would need to maintain

their high standards. They need to do this by hiring right, and incorporate training sessions that ensure an identical organizational culture. Otherwise, they risk:

- Losing customers at the new location

- Earning a poor reputation that affects business at the existing location

Challenge #4: Failing to Scale Properly

Growing a business is an investment: there is a chance the business may lose money in the beginning, but the long-term gains make it worth the effort. Growth efforts come with an element of risk, and businesses need to think strategically to eventually earn larger, consistent returns. Companies need to plan budgets for the growth stages so that they can fund expansion, and afford short-term losses in the pursuit of long-term profits.