What is an Inventory Turnover Ratio?

A general division between small businesses can be done based on service-focused sector and product-focused sector. Several businesses fall into both categories. While a service business is said to be intangible, a product business is tangible and can be felt and measured appropriately by the buyer and seller.

One of the key ways of tracking a product business is through calculating the inventory turnover ratio. This ratio is critical to business owners, creditors and investors as it is an indication of how efficiently your business controls its merchandise.

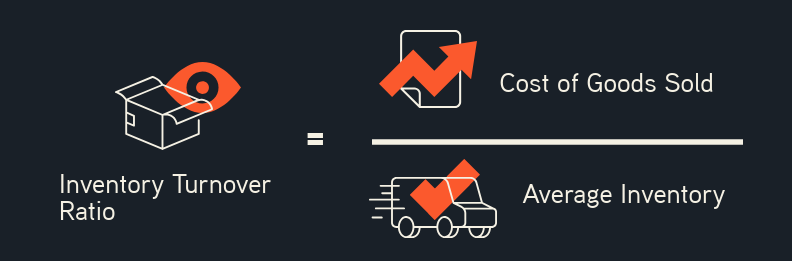

The inventory turnover ratio can be calculated by dividing the overall cost of goods by the number of average inventory, over a certain period of time. It’s also known as an efficiency ratio and can be used by managers and potential investors to understand your business and to measure how many times your inventory has “turned” that is, been sold over a certain period of time.

The inventory ratio should be kept in delicate balance. If you have too much inventory stocked, your operating capital could be high. Too low inventory could mean you aren’t pushing your business to its full potential.

This ratio will help you understand how liquid your inventory is and as the business owner, it’s up to you to monitor how much you’re spending on it. Inventory is one of the major aspects of your business’ balance sheet, and it’s an important factor to both creditors and investors in knowing how fast your business can be turned into cash.

No two businesses are alike and the inventory ratio won’t be common from business to business. Seasonal factors, nature of the industry, etc, can be common reasons why inventory ratios vary. For instance, a shop that sells groceries may have a more regular turnover period than say, a construction equipment supplier.

Most small businesses consider an inventory turn over between 6-12 to be optimum or desirable, although this again isn’t always the case.

Let’s Consider the first variable: Cost of Goods

- If you have a home-made candle shop, the cost of your inventory will include the cost of the wax you buy/make, the cost of wicks, plus the final cost to make the candle.

- If you have clothing store, your cost of goods will be the total price of all of the clothes you bought from a mass-producer or warehouse.

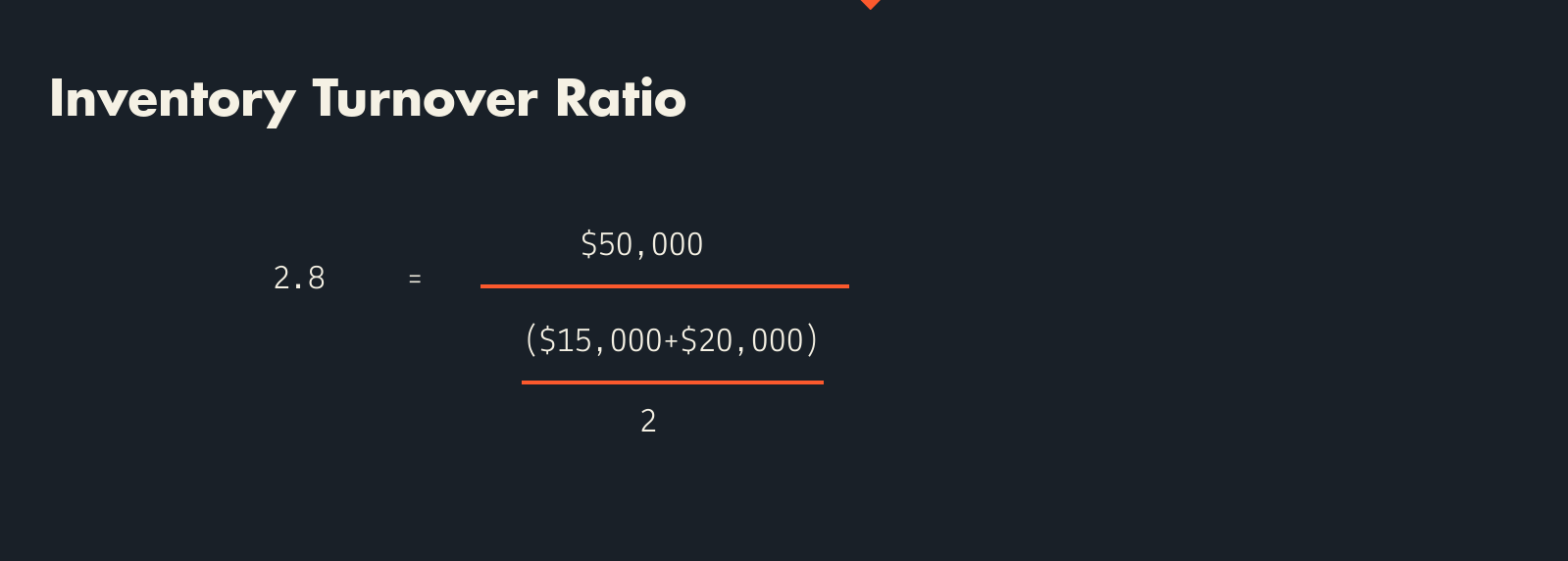

Consider this scenario: Monica owns a seasonal gift shop and reported that her cost of goods sold was $50,000. At the beginning of the year, Monica’s initial inventory was $15,000 and at the end of the year was $20,000. Monica’s Inventory Turnover Ratio can be calculated like this:

As you can see, Monica’s turnover ratio is 2.8. This means that to complete one “turn” of inventory, she will need 130 days to sell all of that inventory. Monica’s inventory control is average.

Thankfully, software can help you keep inventory control such as Quickbooks, Netsuite, Saga 101, etc. Such digital tools can help businesses analyze products, make efficient sales and reorder stock on time.

Now the second variable: Average Inventory

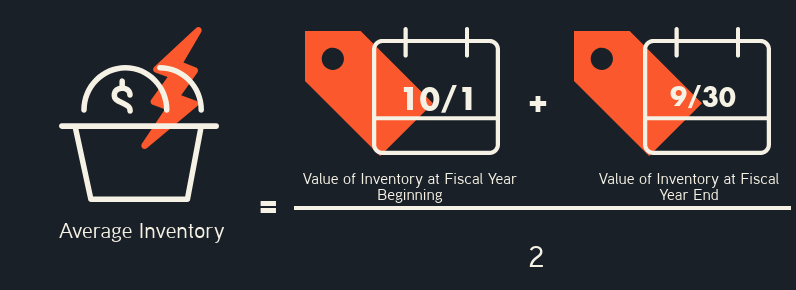

Inventory can change constantly and within a day before or after calculating your average inventory, you can receive a huge sale or a shipment of new inventory. For this reason, the average inventory is taken. Once your costs of goods are calculated, the average inventory isn’t far behind. Costs of goods is for inventory you’ve already sold to a customer. Average inventory is the cost of inventory you still have on hand.

In the example above, you’ll note Monica’s average inventory wasn’t taken, but instead, her end-of-the-year inventory was considered. An analyst may take either into consideration.

The most important factor is the period of consideration for the above calculations, which should be uniform. While some businesses consider a year, other businesses may consider a month or a week and in some cases, even a day.

Improving your Inventory Turnover Ratio

The reason it’s important to understand your inventory turnover ratio is because it indicates how efficiently a company can control its merchandise. Here are the ways in which your business can improve its inventory ratio:

- Limit bulk orders: Although ordering in bulk is a good way to lower expenses, there’s no point holding onto inventory which can’t be sold for a long period of time that may run up cost.

- Monitor Inventory Periodically: Even if your business chooses to calculate your inventory turnover ratio once a year, make sure your inventory is monitored on a regular basis so you don’t face any end-of-year shocks.

- Forecast Your Sales: A critical part of every business is the ability to predict your sales and what you need to do in order to achieve your goals.

- Go on Sale: This is a proven great way to get rid of excess inventory you’ve had for a while now. Sell old inventory for cheaper prices and get them out your business’ door.

The conclusion is simple: your inventory can either be a boost to your business or be holding it back. Monitoring your inventory ratio can help you improve the bottom line of your business and help you make informed purchasing decisions. Reliant Funding helps provide inventory funding for small businesses to purchase extra inventory to ensure your small business stays relevant.